texas estate tax law

The estate or portion of the estate shall either be partitioned and distributed or sold or both in the manner provided for the partition and distribution of property and the sale of property. With bi-partisan support Senate Bill 2.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Being a beneficiary of an estate means carrying the responsibility of paying inheritance tax in certain states but Texas repealed state inheritance tax in 2015.

. And other matters pertaining to ones home or residence. In 2019 the Texas Legislature took a huge step to protect property owners. Texas Property Tax Reform and Transparency Act of 2019.

The following are some of the property tax law changes from the Texas 87th Legislative Session. The short answer is no. However even if this proposal is not adopted this year the current estate tax law is set to reset in 2026 to 5 millionthis is unlikely to be changed.

You might owe money to the federal government though. Home Sales Tax Exemptions. Conduct of the Property Value Study a Definitions.

Property and real estate law includes homestead protection from creditors. According to state law the taxable value for a homestead cannot increase more than 10 percent a year. Home sales are taxable up to 20 under the Texas Tax Law so if you sold your home for 250000 you owe 50000 in taxes.

Senate Bill 1 increases the existing mandatory homestead exemption on. Tax Code Section 1113 b requires school districts to provide a 40000 exemption on a residence homestead and Tax Code Section 1113 n allows any taxing unit to. TAX SALES AND REDEMPTION.

There are not any estate or inheritance taxes in the state of. Among the laws are changes that affect where Texans with Disabled Veteran. A On January 1 of each year a tax lien attaches to property to secure the payment.

The good news is that Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. Texas Comptroller of Public Accounts. 1 Aggregate tax rate means the combined tax rates of all relevant taxing units authorized by law to levy property taxes against a dealers vessel and outboard motor inventory.

Ad Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. ESTATE OF AN INTESTATE NOT LEAVING SPOUSE. Paul Bettencourt of Houston who.

Ad Get an Estate Planning Checklist More to Get the Information You Need. Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. TAX LIENS AND PERSONAL LIABILITY.

Get Access to the Largest Online Library of Legal Forms for Any State. Handbook of Texas Property Tax Rules 1 Texas Property Tax SUBCHAPTER A. With the new year comes dozens of new Texas laws that will take effect on January 1 2022.

The federal estate tax only. Allow the focused estate planning attorneys at Ibekwe Law PLLC in Texas to help guide you through the Texas estate taxes and inheritance laws toward an estate plan that works for you. Regardless of the size of your estate you wont owe estate taxes to the state of Texas.

Relationships between landlords and tenants. From Fisher Investments 40 years managing money and helping thousands of families. The big question is if there are estate taxes or inheritance taxes in the state of Texas.

There is a 40 percent federal tax however on estates over. PRACTICE AND PROCEDURE 9101. That 10 percent cap is why our net appraised value for 2022 is.

A If a person who dies intestate. State revenues are comprised of property taxes sales tax and certain taxes on businesses. 93061 Installment Payments of Taxes on Property Not Directly Damaged in a Disaster or Emergency Area Comments on the proposed rules may be submitted to Shannon Murphy.

Property taxes are local taxes that provide the largest source of money local governments use to pay for schools streets roads police fire protection and many other services. Free Inheritance Information For You Your Lawyer. The owner of an average Texas home worth about 300000 will save around 175 on their annual property tax bill Republican state Sen.

Federal state and local governments all collect taxes in a variety of ways.

Texas Inheritance Laws What You Should Know Smartasset

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada

Texas Inheritance Laws What You Should Know Smartasset

Texas Inheritance And Estate Taxes Ibekwe Law

Texas Estate Tax Everything You Need To Know Smartasset

Do I Have To Pay Taxes On Foreign Inheritance To The Irs International Tax Attorney

Talking Taxes Estate Tax Texas Agriculture Law

Ad Valorem Tax Overview And Guide Types Of Value Based Taxes

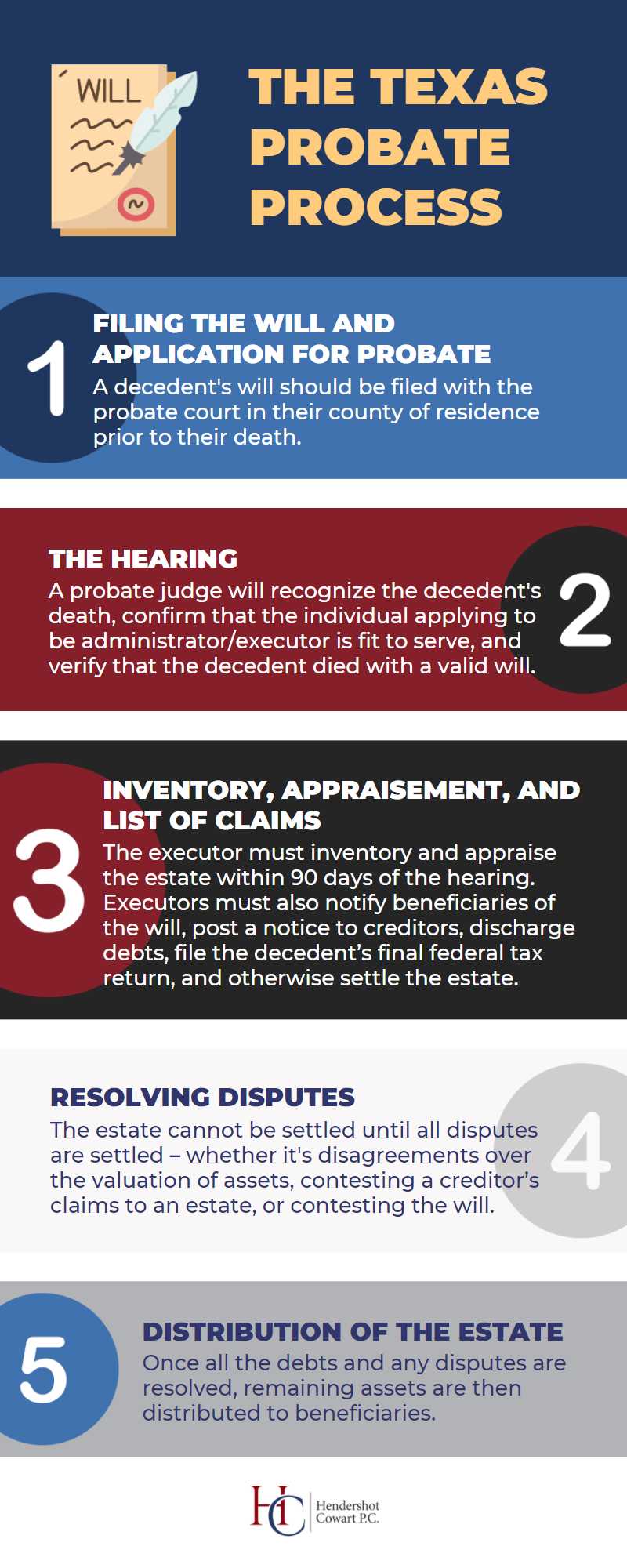

What Is The Probate Process In Texas A Step By Step Guide

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Cypress Texas Property Taxes What You Need To Know Property Tax Tax Attorney Tax Lawyer

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Ultra Rich Skip Estate Tax And Spark A 50 Collapse In Irs Revenue Bloomberg

Texas Estate Tax Everything You Need To Know Smartasset

Texas Estate Tax Everything You Need To Know Smartasset

State Corporate Income Tax Rates And Brackets Tax Foundation

What Qualifies As A Homestead The Word Homestead May Conjure Up Images Of Pioneers Staking Their Claim On Th Republic Of Texas The Conjuring Things To Sell

Ultra Rich Skip Estate Tax And Spark A 50 Collapse In Irs Revenue Bloomberg